Baseball lessons that might help change up your Finances

Baseball stadiums are filled with optimists. Fans start each new season with the hope that even if last year ended badly, this year could finally be the year. After all, teams rally mid-season, curses are broken, and even underdogs sometimes make it to the World Series. As Yogi Berra famously put it, "It ain't over till it's over."1 Here are a few lessons from America's pastime that might inspire you to take a fresh look at your finances.

Proceed One Base at a Time

There's nothing like seeing a home run light up the scoreboard, but games are often won by singles and doubles that put runners in scoring position through a series of hits. The one-base-at-a-time approach takes discipline, something you can apply to your finances. What are your financial goals? Do you know how much money comes in and how much goes out? Are you saving regularly for retirement or for a child's college education? Answering some fundamental questions will help you understand where you are now and help you decide where you want to go.

Cover Your Bases

Baseball players must be positioned and prepared to make a play at the base. What can you do to help protect your financial future in case life throws you a curveball? Try to prepare for those "what ifs." For example, you could buy the insurance coverage you need to help make sure your family is protected. And you could set up an emergency account that you can tap instead of dipping into your retirement funds or using a credit card when an unexpected expense arises.

Take Me Out to the Ball Game

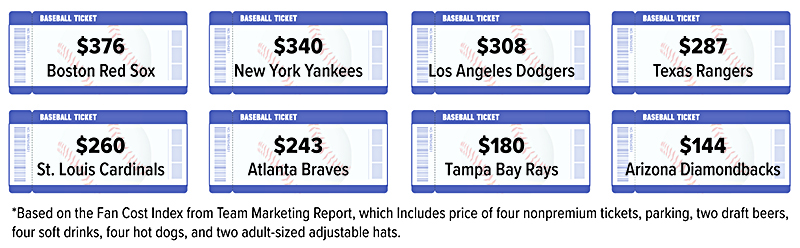

The average cost of taking a family of four to a Major League Baseball game during the 2021 season was $253. Costs varied across the league, with Red Sox fans paying the most and Diamondbacks' fans paying the least.*

Source: The Athletic, 2021

Expect to Strike Out

Fans may have trouble seeing strikeouts in a positive light, but every baseball player knows that striking out is a big part of the game. In fact, striking out is much more common than getting hits. The record for the highest career batting average record is .366, held by Ty Cobb.2 As Ted Williams once said, "Baseball is the only field of endeavor where a man can succeed three times out of ten and be considered a good performer."3

So how does this apply to your finances? As Hank Aaron put it, "Failure is a part of success." 4 If you're prepared for the misses as well as the hits, you can avoid reacting emotionally rather than rationally when things don't work out according to plan. For example, when investing, you have no control over how the market is going to perform, but you can decide what to invest in and when to buy and sell, according to your investment goals and tolerance for risk. In the words of longtime baseball fan Warren Buffett, "What's nice about investing is you don't have to swing at every pitch."5

See Every Day as a New Ball Game

When the trailing team ties the score (often unexpectedly), the announcer shouts, "It's a whole new ball game!" 6

Whether your investments haven't performed as expected, or you've spent too much money, or you haven't saved enough, there's always hope if you're willing to learn from what you've done right and what you've done wrong. Hall of Famer Bob Feller may have said it best. "Every day is a new opportunity. You can build on yesterday's success or put its failures behind and start over again. That's the way life is, with a new game every day, and that's the way baseball is."7

All investing involves risk, including the possible loss of principal. There is no guarantee that any investment strategy will be successful.

1, 3-4, 6-7) BrainyQuote.com

2) ESPN.com

5) quotefancy.com

Non-deposit investment products and services are offered through CUSO Financial Services, LP (“CFS”) a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS:are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal.Investment Representatives are registered through CFS. The Credit Union has contracted with CFS for investment services. Atria Wealth Solutions, Inc. (“Atria”) is a modern wealth management solutions holding company. Atria is not a registered broker-dealer and/or Registered Investment Advisor and does not provide investment advice. Investment advice is only provided through Atria’s subsidiaries. CUSO Financial Services, LP is a subsidiary of Atria.